south dakota property tax laws

SDCL 10-1 Department of Revenue. SDCL 10-6 Annual Assessment of Property.

The Effect Of Tax Laws On Commercial Real Estate Cyber Security Education Coding School Legit Work From Home

The Property Tax Division is responsible for overseeing South Dakotas property tax system including property tax assessments property tax levies and all property tax laws.

. Businesses who would like to apply for reinstatement with the Secretary of States office must first receive a tax clearance certificate from the Department of Revenue. Ad valorem refers to a tax imposed on the value of something as opposed to quantity or. SDCL 10-18A-1 to 10-18A-7 states that certain low income property owners are eligible for a property tax refund and should check with their county treasurer for details and assistance in making application.

South Dakota laws require the property to be equalized to 85 for property tax purposes. The law governs the corporate structure and procedure of nonprofit corporations in South Dakota. Legislative Research Council 500 East Capitol Avenue Pierre SD 57501.

Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year. 2022 - SD Legislative Research Council LRC Homepage SD Homepage. Large areas in the state have simply ceased to carry property taxes and are publicly owned.

Probate is the administrative process by which the deceaseds property both personal and land are collected and distributed to the deceaseds heirs and devisees. There is no authority in state law that allows for a deferment or a delay of the property tax payment deadlines. Article XI 5 provides a property tax exemption for property of the United States and of the state county and municipal corporations both real and personal Article XI 5 is self-executing and needs no statutory language to put the.

128 of home value. To qualify the following conditions must be met. The statewide rate is 450 and most.

South Dakota Nonprofit Corporation Act SD. SDCL 10-5 Situs of Property for Taxation. SDCL 10-9 Assessment of Mobile Homes.

South Dakota also does not levy the gift tax but the federal gift tax applies on gifts totaling more than 15000 in one calendar year. Welcome to FindLaws South Dakota Tax Laws section with up-to-date information for taxpayers in the For most Americans mid-April means that state and federal taxes are due. Article 2069 - Real Estate Brokers and Salespersons 217 W.

Regardless of whether a person dies with a valid will testate or without a valid will intestate their estate will pass through probate. Click on a link below to learn more about South Dakotas property and real estate laws. South Dakotas average effective property tax.

Most of South Dakotas property tax laws are codified in various chapters of Title 10 of the South Dakota Codified Laws. However residents of the Mount Rushmore State are still. Tax amount varies by county.

Under South Dakota law SDCL 10-6-131 landowners may submit a Request for Ag Land Adjustment to the Director of Equalization in the county the land is located in. Aside from inheritance and estate taxes South Dakota is generally a tax friendly state. South Dakota is ranked number twenty seven out of the.

Major rewrite of the property tax laws through SB 12 and SB 15. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. The Department of Revenue has been asked whether a deferment or a delay of the payment of real property taxes is possible.

In this section you will find information about your rights as a tenant including the right to not be discriminated against in addition to homestead laws meant to prevent struggling homeowners from becoming homeless and much more. Laws 47-22-1 et seq. Inheritance taxes are imposed upon the deceaseds heirs after they have received their inheritance.

Taxpayer Bill of Rights. The State of South Dakota does not levy or collect any real. - Pierre SD 57501 Phone.

The property tax is an ad valorem tax on all property that has been deemed taxable by the South Dakota Legislature. 6057733600 For TTY services call 711 Fax. If a condominium or homeowners association is organized as a nonprofit corporation it will be governed by the Act.

There are two sections in the South Dakota Constitution that provide property tax exemptions. But South Dakota residents need only file for federal income taxes since the state does not collect income tax. Sales tax is low in South Dakota.

The authority to levy property taxes The County Director of Equalization DOE assesses the value of all. Tax delinquency is increasing steadily in South Dakota. If the county is at 100 fair market value the.

So even money you earn from a post-retirement job wont be taxed by the state. If someone from another state leaves you an inheritance check local laws. SDCL10-4 Property Subject to Taxation.

Concerns with Meeting Property Tax Deadlines. Property Tax Codified Laws. The last thing you want to deal with is missing a tax payment.

Dlrrealestatestatesdus DLR Home State Home Equal Opportunity Accessibility Policy Contact Us. Visit the South Dakota Secretary of State to find an. Administrative Rules of South Dakota ARSD Regulated by the Commission.

Find a variety of tools and services to help you file pay and navigate South Dakota tax laws and regulations. South Dakota Probate and Estate Tax Laws. Some of the changes included.

The property tax system in South Dakota consists of two parts. The head of the household must be sixty-five years of age or older or shall be disabled prior to January first of the year in. Moreover an ever-increasing amount of land is journeying rapidly toward public ownership1 Causes of such delinquency are varied and complex.

South Dakota Landlord Tenant Laws

South Dakota Landlord Tenant Laws Updated 2020 Payrent

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

South Dakota Property Tax Calculator Smartasset

Why South Dakota Is A Tax Haven For The Rich Local Rapidcityjournal Com

South Dakota Retirement Tax Friendliness Smartasset

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Pioneer Property Management South Dakota

Apply For Your Sales Property Tax Refund South Dakota Department Of Revenue

5 Common Errors When Titling A Vehicle South Dakota Department Of Revenue

Property Tax South Dakota Department Of Revenue

Property Tax Valuation In South Dakota How Is It Calculated Swier Law Firm Prof Llc

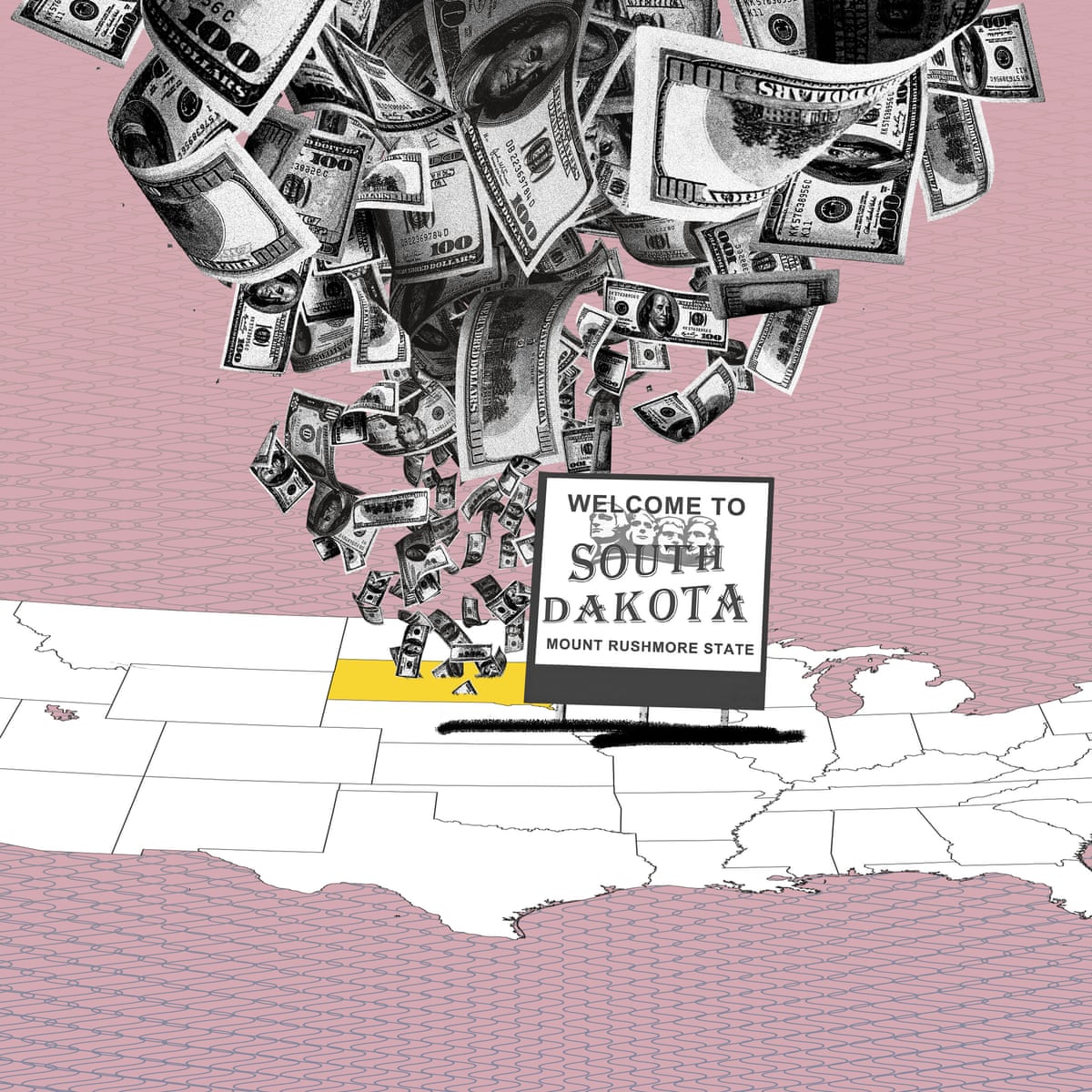

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian

10 Best States To Form An Llc Infographic

Property Tax South Dakota Department Of Revenue